Which Multi-currency Debit Card to apply?

Which Multi-currency Debit Card to apply?

Most of the multi-currency debit cards claimed that they offer very competitive exchange rates, even when they are compared to money changers. But are they really that competitive?

Comparing the exchange rate alone is not good enough. To make a fair comparison, we need to account for all the costs involved in the conversion from one currency to another. Some debit cards claim that their rates are competitive but charge a conversion fees. Others offer a less competitive rate but claim that they do not charge for conversion. I believe the conversion fees is already factor into the exchange rate. Hence it is important to identify all the costs involve to convert from one currency to another.

Here is my findings after making the comparison:

Revolut has the closest rate compared to Money Changer, followed by Citibank, Youtrip, Amaze and TransferWise. See the table below for more details.

Comparison of 6 mutli-currency accounts

Revolut

Revolut does not charge a conversion fee for major currencies if you convert during trading hours, which is Monday to Friday, 24/7, depending on where you are. https://www.revolut.com/en-SG/legal/fees

It’s currency exchange rates is based on interbank rates. When I did a real conversion on 2 Jan 2020, the rate is as good as the money changer. There is no conversion charges as well, unless you convert more than SGD 9000 per month.

How long it takes to open the account: Instant.

Cost to apply for a Debit Card: $0

Account Fees: $0

Minimum balance required: $0

Although it is regulated by Monetary Authority of Singapore (MAS), there is no protection of your currency deposits if it goes bust, so be careful not to put too much money in there.

Global Wallet by Citibank

Citibank does not charge conversion fees to convert from one currency to another.

It’s currency exchange rates are generated from their own units in foreign exchange division.

How long it takes to open the account: If you have an account with citibank, the opening of the Global Waller accounts is instant.

Cost to apply for a Debit Card: $0

Account Fees: $0 if you have a minimum of SGD 15K with Citibank

Minimum balance required: S$15,000

It is regulated by Monetary Authority of Singapore (MAS). Your deposits are insured up to SGD 75K.

TransferWise

TransferWise charges conversion fees of 0.35% – 1% to convert from one currency to another.

Source: It uses the mid-market rate from sources in Google, XE and Yahoo Finance.

How long it takes to open the account: Application of the account is completed within a few hours if the verification is done smoothly.

Although it is regulated by Monetary Authority of Singapore (MAS), there is no protection of your currency deposits if it goes bust, so be careful not to put too much money in there.

YouTrip by Ezlink

Youtrip does not charge conversion fees to convert from one currency to another.

It’s currency exchange rates are from it’s foreign currency partner and Mastercard. Mastercard calculator can be found in this link https://www.mastercard.us/en-us/consumers/get-support/convert-currency.html

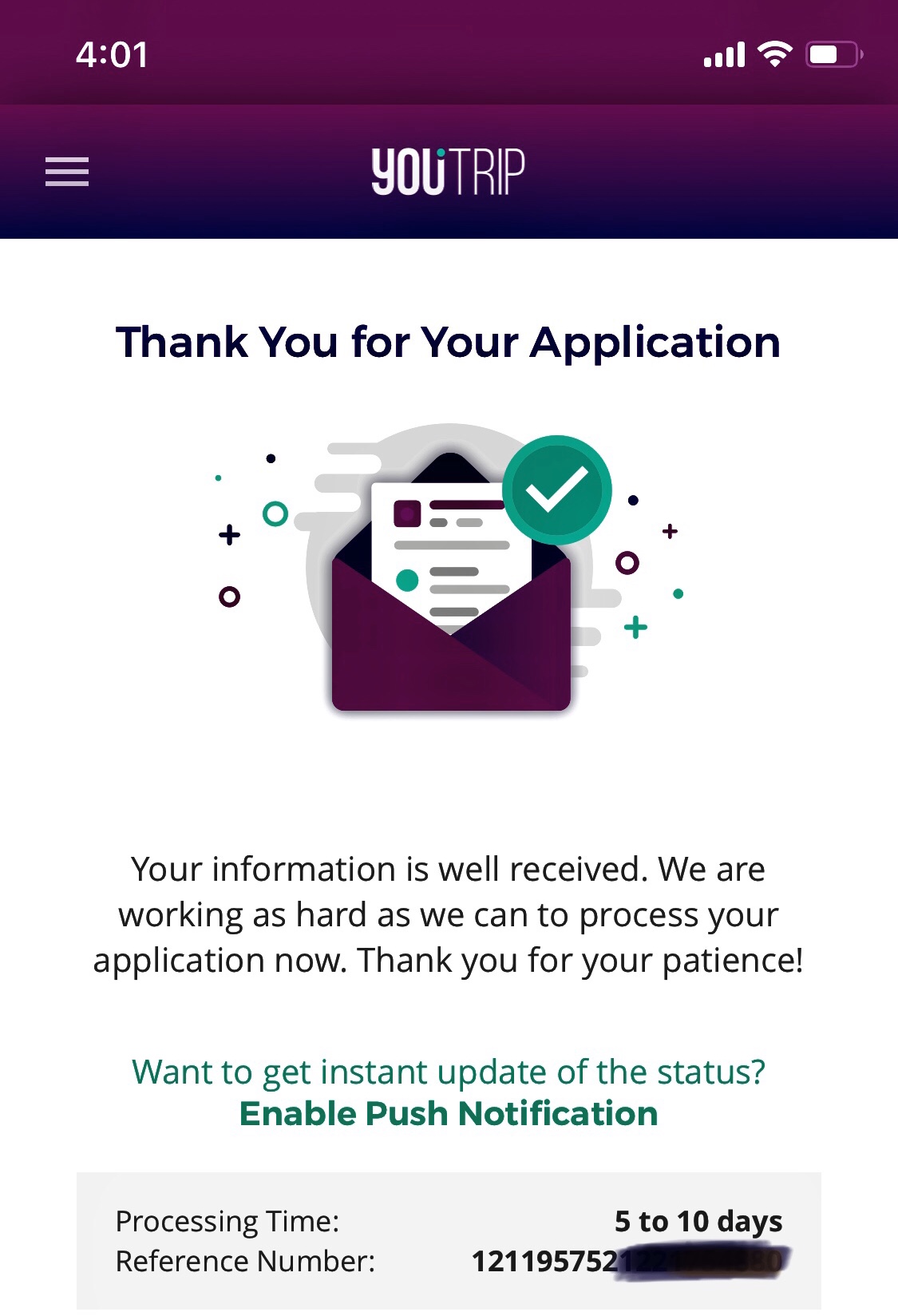

How long it takes to open the account: Application of the account is a long process. They highlighted that they will process your application in 5 to 10 working days.

How long it takes to open a Youtrip account

Cost to apply for a Debit Card: $0

Account Fees: $0

Minimum balance required: $0

It is NOT regulated by Monetary Authority of Singapore (MAS). There is no protection of your currency deposits if it goes bust, so be careful not to put too much money in there.